Intraday forecast basic currencies rates; services of the personal analytical support; partner mutual relations.

середу, 28 лютого 2018 р.

EURUSD intraday forecast (technical side) 2018-03-01

Settlement levels today:

resistance (R1 / R2 / R3 = 1.22266 / 392/596),

Support (S1 / S2 / S3 = 1.21858 / 732/528).

The key resistance levels (1 st from 1.22712 to 1.22105 at the end of the day, 2nd from 1.22873 to 1.22663).

The OsMa indicator marked an increase in the activity of the bulls at breakdown (S2W1 broken), which provides a basis for the planning of trade operations correction ..

Given the state of the Stochastics oscillators, we expect to test the levels (S1 / down H1 broken / EMA24 / S2W1 broken), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

USDCHF intraday forecast (technical side) 2018-03-01

Calculation levels:

resistance (R1 / R2 / R3 = 0.94563 / 729/999),

Support (S1 / S2 / S3 = 0.94023 / 0.93857 / 587).

Key support levels (1 st from 0.93923 to 0.94303 at the end of the day, 2nd from 0.93703 to 0.94073).

The OsMa indicator marked a decrease in the activity of the bulls and confirmed the divergence.

Given the state of the Stochastics oscillators, we expect a test level (R1 / up H1 broken / EMA24), where it is recommended to consider the activity of the parties on the charts of smaller timings.

USDJPY intraday forecast (technical side) 2018-03-01

Calculation levels:

the support (R1 / R2 / R3 = 107.268 / 496/863),

Support (S1 / S2 / S3 = 106,534 / 306 / 105,939).

The key resistance levels (1 st from 107.017 to 106.843 at the end of the day, 2nd from 107.317 to 107.102).

The OsMa indicator marked the bearer OS activity factor during testing (EMA120, up H4).

Given the direction of the Stochastics Oscillators, expect a level test (up H4 / EMA24 / EMA120 / key resistance levels), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

вівторок, 27 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-28

Estimates for today:

resistance (R1 / R2 / R3 = 1.39715 / 1.40042 / 572),

Support (S1 / S2 / S3 = 1.38656 / 329 / 1.37648).

The key resistance levels (1 st from 1.39799 to 1.39119 at the end of the day, 2nd from 1.39867 to 1.39629).

The OsMa indicator marked a decline in the bear's activity and divergence. This provides the basis for planning trade corrections and for today.

Given the state of the Stochastics oscillators, we expect a level test (down H1 / EMA24), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

EURUSD intraday forecast (technical side) 2018-02-28

Settlement levels today:

resistance (R1 / R2 / R3 = 1.223114 / 408/884),

support (S1 / S2 / S3 = 1.22162 / 1.21868 / 392).

The key resistance levels (1 st from 1.23068 to 1.22571 at the end of the day, 2nd from 11.23155 to 1.22842).

The OsMa Indicator marked a significant increase in the bears' breakdown activity (up D1 broken / S1W1 broken), which provides a basis for planning trade operations.

Given the state of the Stochastics Oscillators, we expect to test the levels (S1 / down H4 broken / EMA24 / S1W1 broken), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

USDCHF intraday forecast (technical side) 2018-02-28

Calculation levels:

resistance (R1 / R2 / R3 = 0.94115 / 254/477),

Support (S1 / S2 / S3 = 0.93668 / 529/305).

Key support levels (1 st from 0.93680 to 0.93923 at the end of the day, 2nd from 0.93563 to 0.93703).

The OsMa indicator marked the decline in bull's activity and divergence, which is the basis for the planning of trading transaction corrections for today.

Given the state of the Stochastics oscillators, expect a test level (up H1 / / EMA24 / EMA 522 and R1), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

USDJPY intraday forecast (technical side) 2018-02-28

Calculation levels:

resistance (R1 / R2 / R3 = 107.637 / 837 / 109.176),

Support (S1 / S2 / S3 = 106,948 / 738/398).

Key support levels (1 st from 106,831 to 107,317 at the end of the day, 2nd from 106,750 to 107,017).

The OsMa indicator marked an increase in the activity of the side whipping on the break (up H1 broken).

Given the state of the Stochastics oscillators, we expect a test level (up H1 broken / EMA120 / EMA24), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

понеділок, 26 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-27

Estimates for today:

resistance (R1 / R2 / R3 = 1.40404 / 732 / 1.41781),

Support (S1 / S2 / S3 = 1.38322 / 1.38987 / 445).

Key levels (1 st from 1.39543 to 1.39867 at the end of the day, 2nd from 1.39316 to 1.39799).

The OsMa indicator marked an increase in bulls' activity and divergence with the subsequent return of the course at the edge of the cloud of key levels. This provides the basis for planning trade corrections and for today.

. Given the state of the Stochastics Oscillators, we expect to test the levels (key levels, EMA120, EMA24, EMA522), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

EURUSD intraday forecast (technical side) 2018-02-27

Settlement levels today:

resistance (R1 / R2 / R3 = 1.23444 / 625/918),

Support (S1 / S2 / S3 = 1.22858 / 677/384).

Key support levels (1 st from 1.23050 to 1.23155 at the end of the day, 2nd from 1.22991 to 1.23068).

The OsMaI indicator marked fluctuations in the activity of the parties and confirmed the divergence, which provides the basis for the planning of trading transaction correction.

Given the state of the Stochastics oscillators, expect a level test (down H4 / S1 / key levels / up D1 / S1), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

USDCHF intraday forecast (technical side) 2018-02-27

Calculation levels:

resistance (R1 / R2 / R3 = 0.93920 / 0.94075 / 326),

Support (S1 / S2 / S3 = 0.93418 / 263/012).

The key support levels (1 st from 0.93652 to 0.93680 at the end of the day, 2nd from 0.93539 to 0.93563).

The OsMa indicator marked an increase in the activity of the bulls at breakdowns of the key levels and (down D1 broken), but also confirmed the divergence that is the basis for the planning of trading transaction corrections for today.

Given the state of the Stochastics oscillators, expect a level test (down D1 broken / key resistance levels / EMA24 / EMA 522 / EMA120), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

resistance (R1 / R2 / R3 = 0.93920 / 0.94075 / 326),

Support (S1 / S2 / S3 = 0.93418 / 263/012).

The key support levels (1 st from 0.93652 to 0.93680 at the end of the day, 2nd from 0.93539 to 0.93563).

The OsMa indicator marked an increase in the activity of the bulls at breakdowns of the key levels and (down D1 broken), but also confirmed the divergence that is the basis for the planning of trading transaction corrections for today.

Given the state of the Stochastics oscillators, expect a level test (down D1 broken / key resistance levels / EMA24 / EMA 522 / EMA120), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

USDJPY intraday forecast (technical side) 2018-02-27

Calculation levels:

resistance (R1 / R2 / R3 = 107.111 / 280/553),

Support (S1 / S2 / S3 = 106,564 / 398/121).

Key levels (1 st from 106,658 to 106,750 at the end of the day, 2nd from 106,921 to 106,840).

The OsMa indicator marked an increase in the party's activity, which provides the basis for the planning of trading transaction corrections for today.

Given the neutral state of the Stochastics oscillators, expect a test (key levels / EMA24 / EMA120), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

USDJPY iH4 weekly forecast (technical side) 2018-(02-26/03-02)

Estimated levels per week:

resistance (R1 / R2 / R3 = 107706/108133 / 108,823);

Support (S1 / S2 / S3 = 106.325 / 105.898 / 105.207).

Key levels (1 st from 106,532 to 106,717 at the end of the week, 2nd from 107,757 to 106,972).

The OsMa indicator marked the growth of the bear-side activity at the end of the last trading week, but also confirmed the divergence that provides the basis for planning trade corrections

Given the state of the state of the Stochastics oscillators, we expect a test (key levels, EMA24, EMA120, S1), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

resistance (R1 / R2 / R3 = 107706/108133 / 108,823);

Support (S1 / S2 / S3 = 106.325 / 105.898 / 105.207).

Key levels (1 st from 106,532 to 106,717 at the end of the week, 2nd from 107,757 to 106,972).

The OsMa indicator marked the growth of the bear-side activity at the end of the last trading week, but also confirmed the divergence that provides the basis for planning trade corrections

Given the state of the state of the Stochastics oscillators, we expect a test (key levels, EMA24, EMA120, S1), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

неділю, 25 лютого 2018 р.

GBPUSD weekly forecast (technical side) 2018-(02-26/03-02)

Estimated levels per week:

resistance (R1 / R2 / R3 = 1.40307 / 761 / 1.41.496),

Support (S1 / S2 / S3 = 1.38837 / 383 / 1.37648).

Key levels (1 st from 1.40204 to 1.40196 at the end of the week, 2nd from 1.38671 to 1.39536).

The OsMa indicator marked a slight increase in the activity of the bulls at the end of last week, which provides the basis for planning trading transactions in the triangular zone, limited (down H4, up H4) and possible. The downside variant of development (down W1, up W1)

Given the state of Stochastics oscillators, we expect a key level test, (R1), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

resistance (R1 / R2 / R3 = 1.40307 / 761 / 1.41.496),

Support (S1 / S2 / S3 = 1.38837 / 383 / 1.37648).

Key levels (1 st from 1.40204 to 1.40196 at the end of the week, 2nd from 1.38671 to 1.39536).

The OsMa indicator marked a slight increase in the activity of the bulls at the end of last week, which provides the basis for planning trading transactions in the triangular zone, limited (down H4, up H4) and possible. The downside variant of development (down W1, up W1)

Given the state of Stochastics oscillators, we expect a key level test, (R1), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

пʼятницю, 23 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-23

Estimates for today:

resistance (R1 / R2 / R3 = 1.39813 / 1.40122 / 624),

Support (S1 / S2 / S3 = 1.38809 / 500 / 1.37998).

Key levels (1 st from 1.39552 to 1.39316 at the end of the day, 2nd from 1.39632 to 1.39402).

The OsMa indicator marked an increase in bulls' activity in attempting to break the key resistance levels, but the course returned to the edge of the cloud of resistance. This provides the basis for the planning of trading transaction correction for today.

. Given the state of the Stochastics oscillators, we expect a level test (key levels, EMA120, EMA24), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

четвер, 22 лютого 2018 р.

EURUSD intraday forecast (technical side) 2018-02-23

Settlement levels today:

resistance (R1 / R2 / R3 = 1.23467 / 685 / 1.24036),

support (S1 / S2 / S3 = 1.22765 / 547/196).

The key resistance levels (1 st from 1.23157 to 1.23090 at the end of the day, 2nd from 1.23419 to 1.223164).

The OsMaI verifier confirmed the divergence and noticed an increase in the activity of the bulls on the breakdown (down H4 broken), which provides the basis for the planning of trade corrections.

Given the state of the Stochastics oscillators, we expect to test the levels (1-key levels, douw H4 broken, S1), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

USDCHF intraday forecast (technical side) 2018-02-23

Calculation levels:

resistance (R1 / R2 / R3 = 0.93866 / 0.94068 / 396),

Support (S1 / S2 / S3 = 0.93210 / 008 / 0.92680).

Key levels (1 st from 0.93392 to 0.93537 at the end of the day, 2nd from 0.93687 to 0.93652).

The OsMa indicator confirmed the divergence and the growth of bears' activity at breakdowns of key levels, with the subsequent return of the cloud boundary course, which is the basis for scheduling trade corrections for today.

Given the state of the Stochastics oscillators, expect a level test (EMA120, EMA 24, key levels), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

USDJPY intraday forecast (technical side) 2018-02-23

Calculation levels:

resistance (R1 / R2 / R3 = 107.504 / 779 / 108.226),

Support (S1 / S2 / S3 = 106.610 / 335 / 105.888).

The key resistance levels (1 st from 107.203 to 107.000 at the end of the day, 2nd from 107.576 to 107.240).

The OsMa indicator highlighted the excessive growth of the bearish activity, which provides the basis for the planning of trading transaction corrections for today.

Given the neutral state of Stochastics oscillators, expect a test (EMA24 / EMA120 / S1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

resistance (R1 / R2 / R3 = 107.504 / 779 / 108.226),

Support (S1 / S2 / S3 = 106.610 / 335 / 105.888).

The key resistance levels (1 st from 107.203 to 107.000 at the end of the day, 2nd from 107.576 to 107.240).

The OsMa indicator highlighted the excessive growth of the bearish activity, which provides the basis for the planning of trading transaction corrections for today.

Given the neutral state of Stochastics oscillators, expect a test (EMA24 / EMA120 / S1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

середу, 21 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-22

Estimates for today:

resistance (R1 / R2 / R3 = 1.39798 / 1.40044 / 442),

Support (S1 / S2 / S3 = 1.39002 / 1.38756 / 358).

The key resistance levels (1 st from 1.39863 to 1.39552 at the end of the day, 2nd from 1.39893 to 1.39632).

The OsMa indicator marked the increase in the activity of the pages with the preponderance of the bears.

Given the state of the Stochastics oscillators, expect a test (S1, S2, up H4), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

EURUSD intraday forecast (technical side) 2018-02-22

Settlement levels today:

resistance (R1 / R2 / R3 = 1.223368 / 572/902),

Support (S1 / S2 / S3 = 1.22707 / 503/172).

The key resistance levels (1 st from 1.23530 to 1.23157 at the end of the day, 2nd from 1.23768 to 1.23419).

OsMaI confirmed the divergence and noticed the decrease in the bears' activity, which provides the basis for the planning of trade corrections.

Given the state of the Stochastics oscillators, expect a level test (S1), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

USDCHF intraday forecast (technical side) 2018-02-22

Calculation levels:

resistance (R1 / R2 / R3 = 0.93952 / 0.94079 / 286),

Support (S1 / S2 / S3 = 0.93539 / 412/206).

Key support levels (1 st from 0.93410 to 0.93687 at the end of the day, 2nd from 0.93151 to 0.93392).

The OsMa indicator has confirmed the divergence and the decline of the bulls' activity at break (up H1 broken), which is the basis for the planning of trading transaction corrections for today.

Given the state of the OB oscillators of Stochastics, we expect a test of the levels (EMA522, R1, R2,, up H1 broken), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

USDJPY intraday forecast (technical side) 2018-02-22

Calculation levels:

resistance (R1 / R2 / R3 = 107.816 / 961 / 108.195),

Support (S1 / S2 / S3 = 107,348 / 203 / 106,969).

Key support levels (1 st from 107.081 to 107.584 at the end of the day, 2nd from 106.727 to 107.212).

The OsMa indicator has confirmed the divergence and the growth of the bearer's activity, which provides a basis for the planning of trading transaction correction to date.

Given the state of the Stochastics oscillators, expect a test (EMA23 / key support levels / S1 / S2 / EMA120), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

вівторок, 20 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-21

Estimates for today:

resistance (R1 / R2 / R3 = 1.40195 / 415/771),

Support (S1 / S2 / S3 = 1.39483 / 263 / 1.38907).

The key resistance levels (1 st from 1,39959 to 1.39863 at the end of the day, 2nd from 1.40507 to 1.39893).

The OsMa indicator marked a decrease in the activity of the pages.

Given the state of the Stochastics oscillators, expect a test (key resistance levels / down H1), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

EURUSD intraday forecast (technical side) 2018-02-21

Settlement levels today:

resistance (R1 / R2 / R3 = 1.23892 / 1.24106 / 452),

Support (S1 / S2 / S3 = 1.23199 / 1.22985 / 638).

The key resistance levels (1 st from 1.23976 to 1.23526 at the end of the day, 2nd from 1.24613 to 1.223804).

Indicator OsMa marked a reduction in the activity of bears, which provides the basis for planning trade transactions correction.

Given the state of the Stochastics oscillators, expect a test of the levels (EMA522, S1, down H4 broken), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

USDCHF intraday forecast (technical side) 2018-02-21

Calculation levels:

resistance (R1 / R2 / R3 = 0.93860 / 0.94039 / 328),

Support (S1 / S2 / S3 = 0.9281 / 102 / 0.92812).

Key support levels (1 st from 0.93776 to 0.93506 at the end of the day, 2nd from 0.93950 to 0.93633).

The OsMa indicator marked a decline in the activity of bulls, which is the basis for the planning of trading transactions for today.

Given the state of the OB oscillators of Stochastics, expect a test of the levels (R1, R2, EMA522, up H1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

USDJPY intraday forecast (technical side) 2018-02-21

Calculation levels:

resistance (R1 / R2 / R3 = 107.472 / 599/887),

Support (S1 / S2 / S3 = 106,847 / 670/383).

Key support levels (1 st from 106,500 to 107,081 at the end of the day, 2nd from 106,127 to 106,727).

The OsMa indicator marked divergence and reduced the activity of the party's whipping, which provides a basis for the planning of trading transaction corrections to date.

Given the state of the OB oscillators of Stochastics, expect a test (R2, R3), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

More details of analysis & forecast at through personal appeal (oleksa.bilokon@gmail.com)

понеділок, 19 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-20

Estimates for today:

resistance (R1 / R2 / R3 = 1.40338 / 552/899),

Support (S1 / S2 / S3 = 1.39645 / 431/085). .

The key resistance levels (1 st from 1.40516 to 1.39960 at the end of the day, 2nd from 1.40610 to 1.40507).

The OsMa indicator marked a drop in the activity of the bear side for a breakdown (up H1 broken), which provides a basis for the planning of trading transaction correction to date.

Given the state of the Stochastics oscillators, expect a test (down H1, S1, S2, EMA522), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

USDJPY intraday forecast (technical side) 2018-02-20

Calculation levels:

resistance (R1 / R2 / R3 = 106.754 / 905 / 107.151),

Support (S1 / S2 / S3 = 106.262 / 111 / 105.865).

Key support levels (1 st from 106.349 to 106.500 at the end of the day, 2nd from 106.056 to 106.127).

The OsMa indicator marked a decline in the activity of bulls, which is the basis for the planning of trading transactions for today.

Given the state of the Stochastics oscillators, expect a test level (R2, up H1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

More details of analysis & forecast by through personal appeal (oleksa.bilokon@gmail.com)

USDCHF intraday forecast (technical side) 2018-02-20

Calculation levels:

support (S1 / S2 / S3 = 0.92692 / 558/340),

resistance (R1 / R2 / R3 = 0.93128 / 262/480).

Key support levels (1 st from 0.992506 to 0.92927 at the end of the day, 2nd from 0.92411 to 0.92526).

The OsMa indicator marked a decline in the activity of bulls, which is the basis for the planning of trading transactions for today.

Given the state of the Stochastics Oscillators, expect a level test (R1, up H1, R2, down D1), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

More details of analysis & forecast by through personal appeal (oleksa.bilokon@gmail.com)

EURUSD intraday forecast (technical side) 2018-02-20

Settlement levels today:

support (S1 / S2 / S3 = 1.23755 / 599/346),

resistance (R1 / R2 / R3 = 1.24260 / 416/668).

The key resistance levels (1 st from 1.24533 to 1.24020 at the end of the day, 2nd from 1.24735 to 1.24613).

Indicator OsMa marked a reduction in the activity of bears, which provides the basis for planning trade transactions correction.

Given the state of the Stochastics oscillators, expect a test of the levels (S1, S2, EMA 24, EMA 120), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

More details of analysis & forecast by through personal appeal (oleksa.bilokon@gmail.com)

support (S1 / S2 / S3 = 1.23755 / 599/346),

resistance (R1 / R2 / R3 = 1.24260 / 416/668).

The key resistance levels (1 st from 1.24533 to 1.24020 at the end of the day, 2nd from 1.24735 to 1.24613).

Indicator OsMa marked a reduction in the activity of bears, which provides the basis for planning trade transactions correction.

Given the state of the Stochastics oscillators, expect a test of the levels (S1, S2, EMA 24, EMA 120), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

More details of analysis & forecast by through personal appeal (oleksa.bilokon@gmail.com)

вівторок, 13 лютого 2018 р.

GBPUSD itraday forecast (technical side) 2018-02-14

Estimates for today:

support (S1 / S2 / S3 = 1.38443 / 227 / 1.37877),

resistance (R1 / R2 / R3 = 1.39143 / 359/709).

Key support levels (1 st from 1.38748 to 1.38751 at the end of the day, 2nd from 1.38271 to 1.38501).

The OsMa indicator marked a decrease in the activity of the side whipping during testing (up H4 broken, EMA522), which provides a basis for the planning of trading transaction correction to date.

Given the state of the Stochastics oscillators, expect a test (R1, R2, EMA522), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

(Bear side). For sales positions on a rollover condition (up H4 broken / R1 / R2), targets may be levels (key levels of support / S1 / S2/ S3/ S1W1).

(Side of bulls). For alternative short-term purchases, corrections from (down H4 broken) are targeted (up H4 broken / R1 / R2 / R3/ R1 W1).

support (S1 / S2 / S3 = 1.38443 / 227 / 1.37877),

resistance (R1 / R2 / R3 = 1.39143 / 359/709).

Key support levels (1 st from 1.38748 to 1.38751 at the end of the day, 2nd from 1.38271 to 1.38501).

The OsMa indicator marked a decrease in the activity of the side whipping during testing (up H4 broken, EMA522), which provides a basis for the planning of trading transaction correction to date.

Given the state of the Stochastics oscillators, expect a test (R1, R2, EMA522), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

(Bear side). For sales positions on a rollover condition (up H4 broken / R1 / R2), targets may be levels (key levels of support / S1 / S2/ S3/ S1W1).

(Side of bulls). For alternative short-term purchases, corrections from (down H4 broken) are targeted (up H4 broken / R1 / R2 / R3/ R1 W1).

EURUSD intraday forecast (technical side) 2018-02-14

Settlement levels today:

support (S1 / S2 / S3 = 1.23026 / 1.22821 / 491),

resistance (R1 / R2 / R3 = 1.23686 / 891 / 1.24221).

Key support levels (1 st from 1.22654 to 1.23526 at the end of the day, 2nd from 1.22507 to 1.223128).

Indicator OsMa marked a reduction in the activity of bears, which provides the basis for planning trade transactions correction.

Given the state of the Stochastics oscillators, expect a test of the levels (S2, S1), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

(Side of bulls). For short-term purchases, goals are equal (R1W1 / R3).

(Bear side). An alternative to selling is meaningful when it comes to turning out goals to key levels of support and S1, S2.

Compiled according to the trading platform MT4 from AVATRDE.com

USDCHF intraday forecast (technical side) 2018-02-14

Calculation levels:

support (S1 / S2 / S3 = 0.9281 / 102 / 0.92812),

resistance (R1 / R2 / R3 = 0.93860 / 0.94039 / 328).

The key resistance levels (1 st from 0.93776 to 0.93506 at the end of the day, 2nd from 0.93950 to 0.93633).

The OsMa indicator marked a decrease in the bears' activity, which is the basis for the planning of trade corrections for today.

Given the state of the Stochastics oscillators, expect a level test (S1, S2), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

(Bear side). For short-term sales under the condition of breakdown (S2W1, S2) goals may be (S3, S1MN, down H4 droken).

(Side of bulls). An alternative to purchases under the condition of reversal from (S2W1, S2, S3) with targets to key levels of resistance, and with the condition of breakdown up to (R1, up H1 broken, R2).

Compiled according to the trading platform MT4 from AVATRDE.com

support (S1 / S2 / S3 = 0.9281 / 102 / 0.92812),

resistance (R1 / R2 / R3 = 0.93860 / 0.94039 / 328).

The key resistance levels (1 st from 0.93776 to 0.93506 at the end of the day, 2nd from 0.93950 to 0.93633).

The OsMa indicator marked a decrease in the bears' activity, which is the basis for the planning of trade corrections for today.

Given the state of the Stochastics oscillators, expect a level test (S1, S2), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

(Bear side). For short-term sales under the condition of breakdown (S2W1, S2) goals may be (S3, S1MN, down H4 droken).

(Side of bulls). An alternative to purchases under the condition of reversal from (S2W1, S2, S3) with targets to key levels of resistance, and with the condition of breakdown up to (R1, up H1 broken, R2).

Compiled according to the trading platform MT4 from AVATRDE.com

USDJPY intraday forecast (technical side) 2018-02-14

Calculation levels:

support (S1 / S2 / S3 = 107.453 / 132 / 106.614),

resistance (R1 / R2 / R3 = 108.490 / 811 / 109.330).

The key resistance levels (1 st from 108,646 to 107,843 at the end of the day, 2nd from 108,668 to 108,159).

The OsMa indicator marked diur-gence and reduced the activity of the bear-side.

Given the state of the Stochastics oscillators, expect a test (S2, S2MN, S3W1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

For short-term purchases under the condition of forming reversal signals from (S2 / S2MN) targets are (up MN broken / key resistance levels / R1).

Alternative to sales, under condition of breakdown below S2 with targets up to S3.

Compiled according to the trading platform MT4 from AVATRDE.com

support (S1 / S2 / S3 = 107.453 / 132 / 106.614),

resistance (R1 / R2 / R3 = 108.490 / 811 / 109.330).

The key resistance levels (1 st from 108,646 to 107,843 at the end of the day, 2nd from 108,668 to 108,159).

The OsMa indicator marked diur-gence and reduced the activity of the bear-side.

Given the state of the Stochastics oscillators, expect a test (S2, S2MN, S3W1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

For short-term purchases under the condition of forming reversal signals from (S2 / S2MN) targets are (up MN broken / key resistance levels / R1).

Alternative to sales, under condition of breakdown below S2 with targets up to S3.

Compiled according to the trading platform MT4 from AVATRDE.com

понеділок, 12 лютого 2018 р.

USDCHF intraday forecast (technical side) 2018-02-13

Calculation levels:

support (S1 / S2 / S3 = 0.93658 / 599/454),

resistance (R1 / R2 / R3 = 0.93978 / 0.94067 / 212).

The key resistance levels (1 st from 0.93925 to 0.93776 at the end of the day, 2nd from 0.94083 to 0.93950).

The OsMa indicator marked a decline in the activity of the sites, which is the basis for the planning of trading breakdowns for today.

Given the state of Stochastics oscillators, we expect a test of levels (up H1, key resistance levels), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

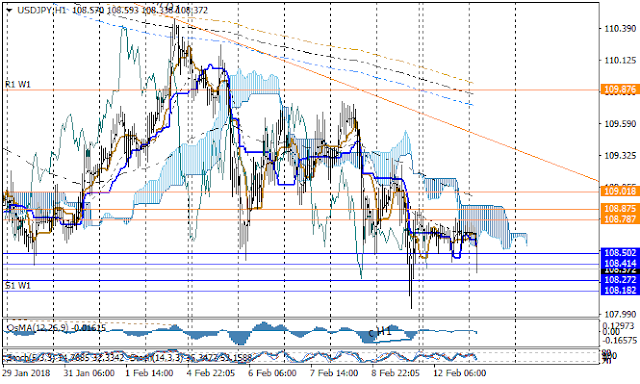

USDJPY intraday forecast (technical side) 2018-02-13

Calculation levels:

support (S1 / S2 / S3 = 108,502 / 414/272),

resistance (R1 / R2 / R3 = 108.787 / 875 / 109.018).

The key resistance levels (1 st from 108.602 to 108.635 at the end of the day, 2nd from 108.906 to 108.898).

The OsMa indicator marked a decline in the bear-side activity.

Given the neutral state of the Stochastics oscillators, expect a S2, S3, S1W1 test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

support (S1 / S2 / S3 = 108,502 / 414/272),

resistance (R1 / R2 / R3 = 108.787 / 875 / 109.018).

The key resistance levels (1 st from 108.602 to 108.635 at the end of the day, 2nd from 108.906 to 108.898).

The OsMa indicator marked a decline in the bear-side activity.

Given the neutral state of the Stochastics oscillators, expect a S2, S3, S1W1 test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

USDJPY H4 weekly forecast (technical side) 2018-02-(12-16)

Estimated levels per week:

support (S1 / S2 / S3 = 108,182 / 107.659 / 106.812),

resistance (R1 / R2 / R3 = 109.876 / 110.399 / 111.246).

The key resistance levels (1 st from 109.373 to 108.255 at the end of the week, 2nd from 109.793 to 109.255).

The OsMa indicator marked a decline in the bear-side activity at the end of the last trading week.

Given the neutral state of the Stochastics oscillators, expect a test (EMA24, S1), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

For short-term sales, if the turn signals are formed from (EMA24), the goals are equal (S1, S2, S3).

An alternative to short-term purchases of corrections from (S1) with goals to levels (down D1), and if it goes above the key levels with goals (R1, R2, R3).

GBPUSD H4 weekly forecast (technical side) 2018-02-(12-16)

Estimated levels per week:

support (S1 / S2 / S3 = 1.37645 / 1.36735 / 1.35262),

resistance (R1 / R2 / R3 = 1.40592 / 1.41502 / 1.42976).

The key resistance levels (1 st from 1.41193 to 1.38947 at the end of the week, 2nd from 1.41610 to 1.40204).

The OsMa indicator marked a decline in the performance of the parties in the breakdown (up H4 broken), which provides a basis for planning trade transactions with a sales advantage.

Given the state of the Stochastics oscillators, we expect a test (up H4 broken, EMA24, EMA120), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

(Bear side). For sales positions on a rollover condition (down H1 / up H4 broken, down H4), targets may be equal (S1 / S2 / S3).

(Side of bulls). Alternative short-term purchases are meaningful when the levels of down (down H4) breakdowns with target-to-key resistance levels, or (R1).

неділю, 11 лютого 2018 р.

USDCHF H4 weekly forecast 2018-02-(12-16)

Estimated levels per week:

support (S1 / S2 / S3 = 0.93428 / 142 / 0.92678), resistance (R1 / R2 / R3 = 0.94355 / 641 / 0.95104).

Key support levels (1 st from 0.93614 to 0.93824 at the end of the week, 2nd from 0.93223 to 0.93620).

For the past week, the OsMa indicator marked the first increase in the activity of the bulls at the attempt to break the key levels and the activity of the bears at the end of the week. The week is open at a rate that exceeds the key levels, which is the basis for the planning of trade transactions correction with the prevalence of purchases.

Given the state of the Stochastics oscillators, we expect a level test (up H1), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

For short-term purchases from (up H1) goals there are (R1, EMA120, R2, R3).

An alternative to positions for sale is meaningful under the conditions of a turn and breakdown below (upH1, S1) with targets up to (S2, down H4 broken, S3, S1MN, up MN).

EURUSD H4 weekly forecast (technical side) 2018-02-w2

Estimated levels per week:

support (S1 / S2 / S3 = 1.22072 / 1.21436 / 1.20408),

resistance (R1 / R2 / R3 = 1.24129 / 765 / 1.25794).

The key resistance levels (1 st from 1.24331 to 1.22823 at the end of the week, 2nd from 1.24485 to 1.23630).

The OsMaI indicator marked the increase in the activity of bulls, which provides the basis for the planning of trade correctional operations.

Given the orientation of the Stochastics oscillators, we expect a level test (down H1, EMA23, EMA120 and S1), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

For short-term sales (down H1) targets are S2, S3.

An alternative to purchases makes sense when the breakdown condition (down H1) is above (EMA120) with the targets for key rescue pawns (R1).

четвер, 8 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-09

Estimates for today:

support (S1 / S2 / S3 = 1.38640 / 119 / 1.37275),

resistance (R1 / R2 / R3 = 1.40329 / 850 / 1.41695).

Key support levels (1 st from 1.39299 to 1.39552 at the end of the day, 2nd from 1.39060 to 1.39505).

The OsMa indicator marked the growth of the party's breakdown activity at breakdown (down H1 broken), which provides the basis for the planning of trading transaction correction and for today.

Given the state of the Stochastics oscillators, expect a test (EMA120 and key levels), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

(Bear side). For sales positions under the condition of forming a turn from (down H4 / R1 / R2 / R3), the targets may be equal (S1 / S2 / S3).

(Side of bulls). For alternative short-term purchases, corrections from (key levels / S1 / down H1 broken) are the target levels (down H4 / R1 / R2 / R3).

support (S1 / S2 / S3 = 1.38640 / 119 / 1.37275),

resistance (R1 / R2 / R3 = 1.40329 / 850 / 1.41695).

Key support levels (1 st from 1.39299 to 1.39552 at the end of the day, 2nd from 1.39060 to 1.39505).

The OsMa indicator marked the growth of the party's breakdown activity at breakdown (down H1 broken), which provides the basis for the planning of trading transaction correction and for today.

Given the state of the Stochastics oscillators, expect a test (EMA120 and key levels), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

(Bear side). For sales positions under the condition of forming a turn from (down H4 / R1 / R2 / R3), the targets may be equal (S1 / S2 / S3).

(Side of bulls). For alternative short-term purchases, corrections from (key levels / S1 / down H1 broken) are the target levels (down H4 / R1 / R2 / R3).

USDCHF intraday forecast (technical side) 2018-02-09

Calculation levels:

support (S1 / S2 / S3 = 0.93428 / 142 / 0.92678), resistance (R1 / R2 / R3 = 0.94355 / 641 / 0.95104).

The key resistance levels (1 st from 0.94119 to 0.94039 at the end of the day, 2nd from 0.93741 to 0.94104).

The OsMa indicator highlighted the growth of the lifetime activity at the breakdown of key levels, which is the basis for the planning of trade correctional operations and for today.

Given the state of the Stochastics oscillators, expect a key resistance test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

For short-term purchases above EMA24 targets are (R1, R2, EMA522, R3).

Alternative for sale items under reverse and breakdown conditions (upH1) with targets up to (S1, S2, down H4 broken).

Compiled according to the trading platform MT4 from AVATRDE.com

EURUSD intraday forecast (technical side) 2018-02-09

Settlement levels today:

support (S1 / S2 / S3 = 1.22235 / 040 / 1.21725),

resistance (R1 / R2 / R3 = 1.22865 / 1.23060 / 375).

The key resistance levels (1 st from 1.23100 to 1.22649 at the end of the day, 2nd from 1.23392 to 1.23082).

The OsMaI Indicator marked the decline in the activity of the bulls in the test (EMA522, EMA24), which provides the basis for the planning of trading transaction corrections for today.

Given the neutral state of Stochastics oscillators, expect a test of the levels (EMA522, EMA24, S1, key resistors), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

For short-term sales targets are S2, S3.

An alternative to purchases is meaningful when the key breakdowns of the resistance and (down H1) with targets up to (R3) are cleared.

Compiled according to the trading platform MT4 from AVATRDE.com

USDJPY intraday forecast (technical side) 2018-02-09

Calculation levels:

support (S1 / S2 / S3 = 108,449 / 146 / 107,656), resistance (R1 / R2 / R3 = 109.430 / 733 / 110,224).

The key resistance levels (1 st from 109.350 to 109.133 at the end of the day, 2nd from 109.077 to 109.011).

The OsMa indicator marked the growth of the bear-side activity at the end of the last trading day.

Given the state of the state of the Stochastics oscillators, expect a key resistance test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

support (S1 / S2 / S3 = 108,449 / 146 / 107,656), resistance (R1 / R2 / R3 = 109.430 / 733 / 110,224).

The key resistance levels (1 st from 109.350 to 109.133 at the end of the day, 2nd from 109.077 to 109.011).

The OsMa indicator marked the growth of the bear-side activity at the end of the last trading day.

Given the state of the state of the Stochastics oscillators, expect a key resistance test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

середу, 7 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-08

Estimates for today:

Support (S1 / S2 / S3 = 1.38507 / 166 / 1.37614)

resistance (R1 / R2 / R3 = 1.39611 / 952 / 1.40504).

The key resistance levels (1 st from 1.39164 to 1.39060 at the end of the day, 2nd from 1.39931 to 1.39299).

The OsMa indicator marked a decline in the activity of the parties during testing (down H1), which provides a basis for the planning of trading transaction correction and for today.

Given the state of the Stochastics oscillators, we expect a test (EMA522, 1-key levels), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

Support (S1 / S2 / S3 = 1.38507 / 166 / 1.37614)

resistance (R1 / R2 / R3 = 1.39611 / 952 / 1.40504).

The key resistance levels (1 st from 1.39164 to 1.39060 at the end of the day, 2nd from 1.39931 to 1.39299).

The OsMa indicator marked a decline in the activity of the parties during testing (down H1), which provides a basis for the planning of trading transaction correction and for today.

Given the state of the Stochastics oscillators, we expect a test (EMA522, 1-key levels), where it is recommended to consider the activity of the parties in the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

USDCHF intraday forecast (technical side) 2018-02-08

Calculation levels:

Support (S1 / S2 / S3 = 0.93617 / 347 / 0.992908), resistance (R1 / R2 / R3 = 0.94495 / 765 / 0.95204).

Key support levels (1 st from 0.93583 to 0.94170 at the end of the day, 2nd from 0.93415 to 0.93795).

The OsMa indicator marked an increase in the activity of the bulls at breakdown (down H4 broken), which is the basis for the planning of trading transaction correction to date.

Given the state of the Stochastics oscillators, expect a test (R1, EMA24), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

More details of analysis & forecast: https://www.mql5.com/en/users/bi0l/blog

or through personal appeal (oleksa.bilokon@gmail.com)

Support (S1 / S2 / S3 = 0.93617 / 347 / 0.992908), resistance (R1 / R2 / R3 = 0.94495 / 765 / 0.95204).

Key support levels (1 st from 0.93583 to 0.94170 at the end of the day, 2nd from 0.93415 to 0.93795).

The OsMa indicator marked an increase in the activity of the bulls at breakdown (down H4 broken), which is the basis for the planning of trading transaction correction to date.

Given the state of the Stochastics oscillators, expect a test (R1, EMA24), where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

More details of analysis & forecast: https://www.mql5.com/en/users/bi0l/blog

or through personal appeal (oleksa.bilokon@gmail.com)

EURUSD intraday forecast (technical side) 2018-02-08

Settlement levels today:

support (S1 / S2 / S3 = 1.22452 / 075 / 1.21463),

resistance (R1 / R2 / R3 = 1.23676 / 1.24053 / 1.25265).

The key resistance levels (1 st from 1.23660 to 1.23100 at the end of the day, 2nd from 1.24016 to 1.23392).

The OsMaIndicator noted an increase in the activity of mediums when passing the EMA522, which provides the basis for the planning of trading transaction corrections for today.

Given the state of the Stochastics oscillators, expect a test of the levels (EMA522, EMA120, S1), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

support (S1 / S2 / S3 = 1.22452 / 075 / 1.21463),

resistance (R1 / R2 / R3 = 1.23676 / 1.24053 / 1.25265).

The key resistance levels (1 st from 1.23660 to 1.23100 at the end of the day, 2nd from 1.24016 to 1.23392).

The OsMaIndicator noted an increase in the activity of mediums when passing the EMA522, which provides the basis for the planning of trading transaction corrections for today.

Given the state of the Stochastics oscillators, expect a test of the levels (EMA522, EMA120, S1), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

USDJPY intraday forecast (technical side) 2018-02-08

Calculation levels:

support (S1 / S2 / S3 = 108,951 / 766/468), resistance (R1 / R2 / R3 = 109.547 / 732 / 110,030).

The key resistance levels (1 st from 109.385 to 109.352 at the end of the day, 2nd from 109.221 / 110 to 109.077).

The OsMa indicator marked a decrease in counterparty activity.

Given the state of the Stochastics oscillators, expect S1, S2, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

support (S1 / S2 / S3 = 108,951 / 766/468), resistance (R1 / R2 / R3 = 109.547 / 732 / 110,030).

The key resistance levels (1 st from 109.385 to 109.352 at the end of the day, 2nd from 109.221 / 110 to 109.077).

The OsMa indicator marked a decrease in counterparty activity.

Given the state of the Stochastics oscillators, expect S1, S2, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

вівторок, 6 лютого 2018 р.

GBPUSD intraday forecast (technical side) 2018-02-07

Estimates for today:

support (S1 / S2 / S3 = 1.38678 / 292 / 1.37668),

resistance (R1 / R2 / R3 = 1.39925 / 1.40311 / 934).

The key resistance levels (1 st from 1.40143 to 1.39164 at the end of the day, 2nd from 1.41068 to 1.39922).

the OsMa indicator has confirmed the divergence with the further decrease in the activity of the bear and the growth of the activity of the bulls at the breakdown (down H1 broken), which provides the basis for the planning of trade correctional operations and for today.

Given the state of the Stochastics oscillators, expect a test (S1, 1-key levels and down H1 broken, EMA522), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

support (S1 / S2 / S3 = 1.38678 / 292 / 1.37668),

resistance (R1 / R2 / R3 = 1.39925 / 1.40311 / 934).

The key resistance levels (1 st from 1.40143 to 1.39164 at the end of the day, 2nd from 1.41068 to 1.39922).

the OsMa indicator has confirmed the divergence with the further decrease in the activity of the bear and the growth of the activity of the bulls at the breakdown (down H1 broken), which provides the basis for the planning of trade correctional operations and for today.

Given the state of the Stochastics oscillators, expect a test (S1, 1-key levels and down H1 broken, EMA522), where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

USDJPY intraday forecast (technical side) 2018-02-07

Calculation levels:

support (S1 / S2 / S3 = 108,776 / 479 / 107.998), support (R1 / R2 / R3 = 109.739 / 110.036 / 518).

Key levels (1 st from 109,505 to 109,460 at the end of the day, 2nd from 110,306 / 110 to 109,305).

The OsMa indicator marked a marked fluctuation in the counterparty's activity.

Given the state of Stochastics oscillators, expect a key level test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

support (S1 / S2 / S3 = 108,776 / 479 / 107.998), support (R1 / R2 / R3 = 109.739 / 110.036 / 518).

Key levels (1 st from 109,505 to 109,460 at the end of the day, 2nd from 110,306 / 110 to 109,305).

The OsMa indicator marked a marked fluctuation in the counterparty's activity.

Given the state of Stochastics oscillators, expect a key level test, where it is recommended to consider the activity of the parties on the charts of smaller timeframes.

Compiled according to the trading platform MT4 from AVATRDE.com

More details of analysis & forecast : https://www.mql5.com/en/users/bi0l/blog

USDCHF intraday forecast (technical side) 2018-02-07

Calculation levels:

support (S1 / S2 / S3 = 0.93195 / 0.92980 / 632), resistance (R1 / R2 / R3 = 0.93891 / 0.94106 / 454).

Key support levels (1 st from 0.93329 to 0.93583 at the end of the day, 2nd from 0.93151 to 0.93415).

The OsMa indicator marked the fluctuation of the parties' activity at testing levels (up H1, down H4), which is the basis for the planning of trading transaction correction and for today.

Given the state of the Stochastics oscillators, expect a test (EMA24, EMA120, up H1) and key levels with a possible down H4 test, where it is recommended to consider the activities of the parties in the charts of smaller timeframes.

More details of analysis & forecast

https://www.mql5.com/en/users/bi0l/blog

or through personal appeal (oleksa.bilokon@gmail.com)

Підписатися на:

Дописи (Atom)