Support (S1 / S2 / S3 = 39,83 / 39,48 / 38,93), resistance (R1 / R2 / R3 = 40,94 / 41,29 / 41,85).

Key resistance levels (1st from 40.13 to 40.48 at the end of the day, the 2nd of 40.48 to 41.51).

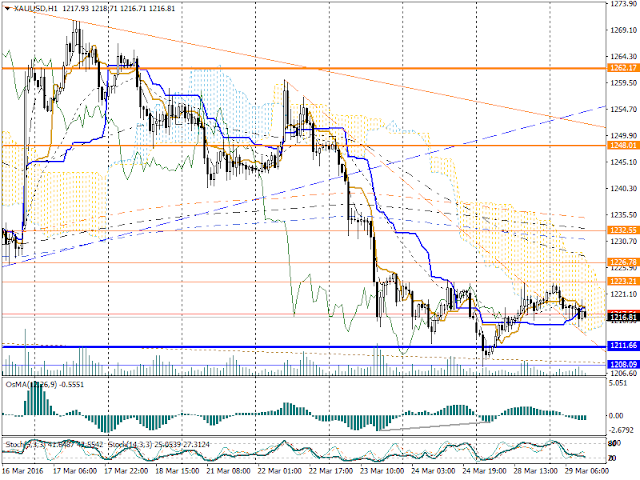

Indicator OsMa bears marked increase in activity late last trading day, which provides a basis for planning of trading operations for today and correction.

More details of analysis & forecast :